Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS COLLPLANT HOLDINGS LTD.

As filed with the Securities and Exchange Commission on December 2, 2016

Registration No. 333-214188

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CollPlant Holdings Ltd.

(Exact name of registrant as specified in its charter)

| State of Israel (State or other jurisdiction of incorporation or organization) |

3842 (Primary Standard Industrial Classification Code Number) |

Not applicable (I.R.S. Employer Identification No.) |

3 Sapir Street, Weizmann Science Park

Ness-Ziona 74140, Israel

Tel: +972 73 232 5600

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware

+1 302 738 6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Mark S. Selinger, Esq. Gary M. Emmanuel, Esq. McDermott Will & Emery LLP 340 Madison Avenue New York, NY 10173 +1 212 547 5400 |

Perry Wildes, Adv. Adva Bitan, Adv. Gross, Kleinhendler, Hodak, Halevy, Greenberg & Co. One Azrieli Center, Round Building Tel Aviv 6701101, Israel +972 3 607 4520 |

Ivan K. Blumenthal, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. 666 Third Avenue New York, NY 10017 +1 212 935 3000 |

Ron Sitton, Adv. Sharon Rosen, Adv. Fischer Behar Chen Well Orion & Co. 3 Daniel Frisch St. Tel Aviv 6473104 Israel Tel: 972-3-6944111 Fax: 972-3-6091116 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(2)(3)(4) |

Amount of registration fee(5)(6) |

||

|---|---|---|---|---|

Ordinary Shares, par value NIS 0.03 per share, represented by American Depositary Shares(1) |

$25,357,500 | $2,939 | ||

Total Registration Fee |

$25,357,500 | $2,939 | ||

|

||||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission has declared this registration statement effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state or jurisdiction where such offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED DECEMBER 2, 2016

CollPlant Holdings Ltd.

3,500,000 AMERICAN DEPOSITARY SHARES

EACH REPRESENTING 50 ORDINARY SHARES

This is our initial public offering in the United States. We are offering 3,500,000 American Depositary Shares, or ADSs. Each ADS represents 50 of our ordinary shares, par value NIS 0.03 per share. We anticipate that the initial public offering price of the ADSs will be between $5.30 and $6.30 per ADS.

We have applied to list the ADSs on the NASDAQ Capital Market, under the symbol "CLGN." Our ordinary shares currently trade on the Tel Aviv Stock Exchange, or TASE, under the symbol "CLPT," and the ADSs are currently quoted on the OTCQX marketplace, or OTCQX, under the symbol "CQPTY." On December 1, 2016, the closing price of our ordinary shares on the TASE was NIS 0.412, or $0.11 per share (based on the exchange rate reported by the Bank of Israel on such date) and after giving effect to a 1-for-3 reverse stock split of our ordinary shares effected on November 20, 2016, and equivalent to a price of $5.37 per ADS, after giving effect to an adjustment to the ratio of ADSs to ordinary shares from one ADS representing 100 ordinary shares to one ADS representing 50 ordinary shares which was effected on November 21, 2016. The closing price of the ADSs on OTCQX on December 1, 2016, was $5.45 per ADS, after giving effect to a 1-for-3 reverse stock split of our ordinary shares effected on November 20, 2016 and the aforementioned adjustment to the ratio of ADSs to ordinary shares. Assuming that the ADSs are listed for trading on the NASDAQ Capital Market, the quoting of the ADSs on OTCQX will be discontinued prior to the completion of this offering.

We are an emerging growth company, as defined in the U.S. Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in the ADSs involves a high degree of risk. See "Risk Factors" beginning on page 15 of this prospectus.

|

||||

| |

Per ADS |

Total |

||

|---|---|---|---|---|

Initial public offering price |

$ | $ | ||

Underwriting discounts and commissions(1) |

$ | $ | ||

Proceeds to us (before expenses) |

$ | $ | ||

|

||||

The underwriters have an option to purchase up to 525,000 additional ADSs from us at the initial public offering price, less the underwriting discounts and commissions payable by us, for 30 days after the date of this prospectus to cover over-allotments, if any.

Certain of our existing shareholders and an officer have indicated an interest in purchasing an aggregate of up to approximately $5,000,000 of ADSs in this offering at the public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters may determine to sell more, fewer, or no ADSs in this offering to any of these parties, or any of these parties may determine to purchase more, fewer, or no ADSs in this offering. The underwriters will receive the same underwriting discount on any ADSs purchased by these parties as they will on shares sold to the public in this offering.

None of the United States Securities and Exchange Commission, the Israel Securities Authority, or any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ADSs to the purchasers in this offering on or about , 2016.

Book-Running Manager

Ladenburg Thalmann

Lead Manager

Roth Capital Partners

The date of this prospectus is , 2016.

Until and including , 2017 (25 days after the date of this prospectus), all dealers that buy, sell, or trade the ADSs, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus and any related free-writing prospectus that we authorize to be distributed to you. We have not, and the underwriters have not, authorized any person to provide you with information different from that contained in this prospectus or any related free-writing prospectus that we authorize to be distributed to you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies, regardless of the time of delivery of this

i

prospectus or of any sale of the securities offered hereby. Our business, financial condition, results of operations, and prospects may have changed since that date. Neither we nor the underwriters take any responsibility for, nor do we provide any assurance as to the reliability of, any information other than the information in this prospectus and any free writing prospectus prepared by us or on our behalf. Neither the delivery of this prospectus nor the sale of the ADSs means that information contained in this prospectus is correct after the date of this prospectus.

Market data and certain industry data and forecasts used throughout this prospectus were obtained from sources we believe to be reliable, including market research databases, publicly available information, reports of governmental agencies, and industry publications and surveys. We have relied on certain data from third-party sources, including internal surveys, industry forecasts, and market research, which we believe to be reliable based on our management's knowledge of the industry. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" and elsewhere in this prospectus.

Our financial statements are prepared and presented in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our historical results do not necessarily indicate our expected results for any future periods.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

Unless derived from our financial statements or otherwise noted, the terms "shekels," "Israeli shekels," and "NIS" refer to New Israeli Shekels, the lawful currency of the State of Israel, and the terms "dollar," "U.S. dollar," "US$," "USD," and "$" refer to U.S. dollars, the lawful currency of the United States.

We own various trademark registrations, trademark applications, unregistered trademarks, and trade names, including, among others: "collage" and "Vergenix." All other trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, trademarks and trade names in this prospectus may be referred to without the symbols ® and TM, but such references should not be construed as any indication that their respective owners will not assert, to the fullest extent under applicable law, their rights to those trademarks or trade names.

Notice to Prospective Investors in Israel

This document does not constitute a public offering or selling or a solicitation of an offer to sell any kind of securities under the Israeli Securities Law. This document does not constitute a prospectus under the Israeli Securities Law and has not been filed with or approved by the Israel Securities Authority. Any public offering in Israel requires a pre-approved permit by the Israel Securities Authority or an exemption thereof. In Israel, this prospectus may be distributed only to, and may be directed only at the types of, investors listed in the first addendum, or the Addendum, to the Israeli Securities Law, consisting primarily of funds for joint investment in trust funds; provident funds; insurance companies; banks, portfolio managers and members of the Tel Aviv Stock Exchange, Ltd., each purchasing for their own account or for clients which are types of investors listed in the Addendum; investment advisors and underwriters, each purchasing for their own account; venture capital funds; entities with equity in excess of NIS 50.0 million; and "qualified individuals," each as defined in the Addendum (as it may be amended from time to time), collectively referred to as qualified investors. Qualified investors shall be required to submit written confirmation that they fall within the scope of the Addendum.

ii

This summary highlights selected information about us and the ADSs that we are offering. This summary does not contain all of the information you should consider before investing in the ADSs. Before making an investment in the ADSs, you should read the entire prospectus carefully for a more complete understanding of our business and this offering, including our consolidated financial statements and the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in this prospectus. Unless the context requires otherwise, the terms "CollPlant," "we," "us," "our," "the Company," and similar designations refer to CollPlant Holdings Ltd. and its wholly owned subsidiary CollPlant Ltd. Unless derived from our financial statements or otherwise indicated, U.S. dollar translations of NIS amounts presented in this prospectus are translated using the rate of NIS 3.758 to one U.S. dollar, the exchange rate reported by the Bank of Israel for September 30, 2016.

Overview

We are a clinical-stage regenerative medicine company focused on developing and commercializing tissue repair products, initially for the orthobiologics and advanced wound care markets. Our product candidates are based on our rhCollagen, a form of human collagen produced with our proprietary plant-based genetic engineering technology. We believe our technology is the only commercially viable technology available for the production of genetically engineered, or recombinant, human collagen. We believe that our rhCollagen, which is identical to the type I collagen produced by the human body, has significant advantages compared to currently marketed tissue-derived collagens, including improved biofunctionality, superior homogeneity, and reduced risk of immune response. We believe the attributes of our rhCollagen make it suitable for numerous tissue repair applications in orthobiologics and advanced wound care throughout the human body. Orthobiologics use cell-based therapies and biomaterials to promote healing. Advanced wound care is composed of biocompatible products that are intended to actively promote wound healing by interacting either directly or indirectly with wound tissues. We believe that the annual market opportunity for our current product candidates utilizing our rhCollagen within the orthobiologics and advanced wound care markets exceeds $5 billion. We have not generated any material revenue from product sales to date. We have incurred losses in each year since our inception in 2004, and have an accumulated deficit of $40.3 million as of September 30, 2016. Our recurring net losses and negative cash flows from operations have raised substantial doubt about our ability to continue as a going concern, and as a result, our independent registered public accounting firm has noted this in the opinion they issued on our consolidated financial statements for the year ended December 31, 2015. We anticipate that we will continue to incur losses for the foreseeable future and we may never be profitable.

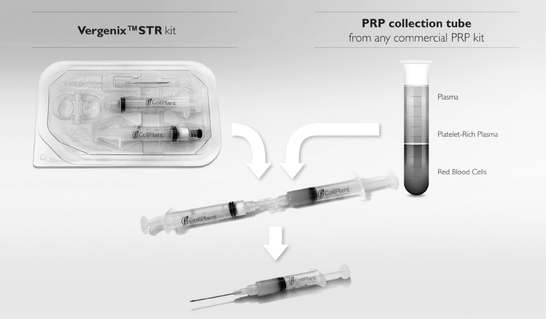

Our VergenixSTR product candidate is a soft tissue repair matrix which combines cross-linked rhCollagen with platelet-rich plasma, or PRP, and is intended to accelerate healing in the treatment of tendinopathy. In August 2016, we completed an open label, single arm, multi-center clinical trial of VergenixSTR in Israel. In October 2016, we received CE marking certification for VergenixSTR, which is required for a product to be marketed in the European Union. In November 2016, we entered into an exclusive distribution agreement with Arthrex GmbH in Munich, Germany, an affiliate of Arthrex, Inc. for VergenixSTR covering Europe, the Middle East, India, and certain African countries.

Our VergenixFG product candidate is a wound-filling flowable gel made from our rhCollagen intended to enhance the quality and speed of closure of deep surgical incisions and wounds, including diabetic ulcers, burns, bedsores, and other chronic wounds. We completed an open label, single arm, multi-center clinical trial of VergenixFG in Israel to support CE marking certification. In February 2016, we received CE marking certification for VergenixFG, and in July 2016, we supplied our first order in Europe. To bring our initial two product candidates to market, we intend to first commercialize the product candidates in Europe and expect to pursue U.S. Food and Drug

1

Administration, or FDA, approval, under the pre-market approval, or PMA regulatory pathway, for our rhCollagen-based products.

We are developing a bone graft surgical matrix, which we refer to as the CollPlant Surgical Matrix, in collaboration with Bioventus LLC, or Bioventus, a global leader in active orthopedic healing. The CollPlant Surgical Matrix is a novel resorbable carrier composed of rhCollagen and synthetic minerals which is intended to be charged with a bone morphogenic protein, or BMP, developed by Bioventus for use as a bone graft substitute in bone repair indications such as spinal fusion and trauma. The CollPlant Surgical Matrix charged with a BMP, which we refer to as the Bioventus product candidate, is intended to stimulate the recruitment and differentiation of bone-forming cells, which can heal existing bone and produce new natural bone. We are party to a non-binding term sheet entered into on July 9, 2015 with Bioventus for the license and supply of the CollPlant Surgical Matrix. In anticipation of filing an Investigational New Drug application, or IND, Bioventus is undertaking preclinical animal studies comparing the Collplant Surgical Matrix to other active comparators. While negotiations for a binding license and supply agreement are ongoing, no license and supply agreement has been entered into and there can be no assurance that we will enter into any definitive agreement with Bioventus.

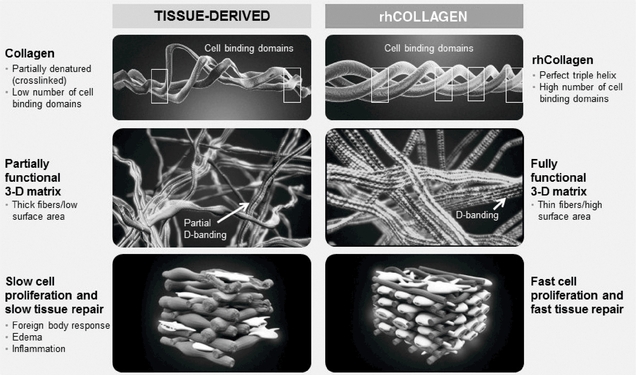

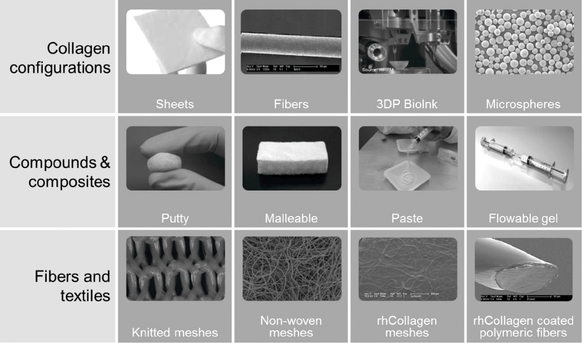

Our rhCollagen has superior biological function when compared to any tissue-derived collagens, whether from animal or human tissues, according to data published in peer-reviewed scientific publications. Our rhCollagen can be fabricated in different forms, shapes, and viscosities including gels, pastes, sponges, sheets, membranes, fibers, and thin coats, all of which have been tested in vitro and in animal models and proven superior to tissue-derived products. These different forms of our rhCollagen broaden the potential applications of our products. For example, collagen gels made of our rhCollagen are more homogenous and less viscous compared to tissue-derived collagens, making the rhCollagen gels ideal for any injectable product. We have demonstrated that, due to its homogeneity, rhCollagen can produce fibers and membranes with high molecular order, meaning all the molecules are oriented in the same direction, which enables the formation of tissue repair products with distinctive physical properties, including improved tensile strength due to the alignment of the collagen fibers, higher levels of transparency, and the ability to achieve high concentrations of collagen at low viscosities. The unique properties of our rhCollagen make it an ideal building block for many products such as BioInks for 3-D printing, artificial tendons, and transparent ophthalmic products that we believe cannot currently be produced using tissue-derived collagens.

The production of our rhCollagen begins when five human genes essential for the production of collagen are introduced into a tobacco plant. The genetically engineered tobacco plantlets are distributed to qualified greenhouses across Israel, where they are grown to maturity, which takes about eight weeks. The tobacco leaves are then harvested and processed to an extract, which undergoes purification until the final rhCollagen product is produced. Cost-effective production, the abundant supply of raw materials, and the resulting product, pristine human collagen, are the most important features of plant-based production. We are advancing a new production process that we believe will result in higher yields and labor cost reductions, assuring adequate supply as demand for rhCollagen increases.

Advantages of Our rhCollagen and rhCollagen-based Products

Collagen is the main component of connective tissue, comprising approximately 30% of the protein found in the human body. Type I collagen is the most abundant form of collagen and serves as the primary scaffold in tissue or organ repair processes, making it a logical choice for regenerative medicine products. We estimate the size of the total market for human collagen-based tissue repair products for use in orthobiologics and advanced wound care applications is approximately $20 billion. Currently, collagen for medical use is primarily derived from bovine (cow) and porcine (pig) sources, as well as from human cadavers. It is extracted from the tissues using mechanical processes and chemical treatments. All of our product candidates are based on our proprietary recombinant type I human

2

collagen, rhCollagen. Our rhCollagen has many advantages over tissue-derived collagens, as outlined below:

| Tissue-Derived Collagens | rhCollagen | |

|---|---|---|

• Defects in the protein structure, resulting in significant damage to binding sites for progenitor cells, which are cells that, when activated by binding to the scaffold, proliferate, or multiply, and differentiate into appropriate tissue. |

• A pristine triple helix structure identical to native collagen, resulting in optimal binding sites for progenitor cells supporting endothelial, fibroblast, and keratinocyte cell attachment and proliferation. |

|

Advantage: In all cell types tested in vitro, cell proliferation was significantly better in scaffolds made of rhCollagen than in commercially available scaffolds made of bovine collagen. The accelerated cell proliferation achieved with rhCollagen results in faster wound healing, less scarring, and overall high-quality tissue regeneration. |

||

• High proportions of cross-linked, or bonded, collagen molecules, leading to collagen building blocks with high and varying molecular weights, which can impair the collagen's ability to self-assemble homogenous scaffolds and impede its rate of degradation. |

• Allows for the precise control over the degree of cross-linked collagen due to the homogeneity of rhCollagen, enabling consistent and reproducible products with a controlled degradation rate. |

|

Advantage: Precise control over the proportion of cross-linked collagen allows us to optimize the degradation rate of rhCollagen to the targeted indication. Achieving the same level of engineered performance would be difficult, if not impossible, with tissue-derived collagens that varies from batch to batch. |

||

• Tissue-derived collagens, in many cases, contain residual contaminant proteins, growth factors, and cytokines, or signaling proteins, and carries a risk of disease transmission. As a result, scaffolds made of tissue-derived collagens may provoke inflammation, as well as undesirable immune and foreign body responses that may cause adverse effects and unpredictable biological outcomes. |

• Our rhCollagen is composed of pure molecules that are identical to type I human collagen. It has no residues of growth factors which can lead to potential side effects, does not induce an immune response, and carries no risk of transmitting diseases and pathogens. |

|

Advantage: In vitro studies performed under an academic collaboration have demonstrated that rhCollagen incubated with activated THP1-macrophages produces significantly lower levels of inflammatory cytokines when compared with bovine collagen, demonstrating that animal-derived collagen can provoke a foreign body response not seen with rhCollagen. This foreign body response delays healing and increases scarring. |

||

The advantages of our rhCollagen outlined above have been demonstrated through in vitro testing and in preclinical animal studies, and are based on the performance of rhCollagen alone. The performance demonstrated in these studies is not necessarily indicative of the performance of our product candidates which contain rhCollagen. We cannot assure you that the same advantages of rhCollagen will be observed in clinical testing of our product candidates containing rhCollagen.

3

Our Strategy

We plan to exploit the unique characteristics of our rhCollagen to develop and commercialize an extensive portfolio of regenerative medicine products. The key elements of our strategy include the following:

4

Our Product Candidates

VergenixSTR—Tendinopathy Treatment

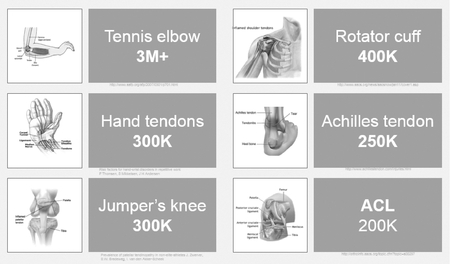

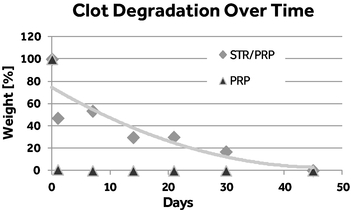

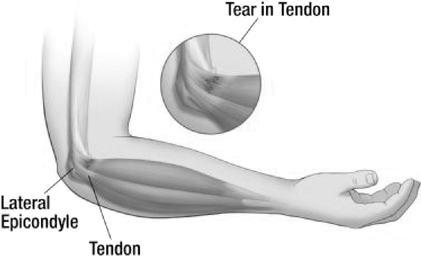

VergenixSTR is a soft tissue repair matrix composed of our rhCollagen and platelet-rich plasma, or PRP, extracted from a patient's blood. VergenixSTR is intended for the treatment of tendinopathy, such as in the elbow tendon (for treatment of "tennis elbow"), rotator cuff, patellar tendon, Achilles tendon, and hand tendons. VergenixSTR is injected into the affected area, and forms a viscous gel matrix which serves as a scaffold in the vicinity of a tendon injury site, inducing the platelet concentrate to remain in place at the injured area, enabling optimal healing. In a preclinical study of 54 rats based on an established model of tendinopathy induced in rats, VergenixSTR resulted in lower initial inflammatory mononuclear cell levels, which correlates with a reduction in pain. This effect, along with observations on the appearance of mature fibrosis and elimination of early granulated tissue, suggests that VergenixSTR may accelerate the healing of tendons in comparison with the control treatment of PRP alone.

In August 2016, we completed an open label, single arm, multi-center clinical trial of VergenixSTR of 40 patients in Israel intended to demonstrate safety and to evaluate the performance of VergenixSTR in patients suffering from tennis elbow or lateral epicondylitis, an inflammation of the tendons that join the forearm muscles on the outside of the elbow. The trial, which commenced in January 2015, initially enrolled 20 patients and was expanded to enroll an additional 20 patients. Patients enrolled in the trial received a one-time injection of VergenixSTR and are monitored for the level of pain, tendon healing, and recovery of hand movement at three and six months after treatment.

Results of the trial indicated that VergenixSTR was found to be safe for use on human subjects. At the three-month and six-month follow ups, patients treated with VergenixSTR reported an average 51% and 59% reduction in pain and improvement in motion, respectively, as measured by score improvement over the baseline on the Patient-Rated Tennis Elbow Evaluation, or PRTEE, questionnaire. The PRTEE questionnaire is designed to measure reduction in pain and recovery of motion for patients with tennis elbow.

Furthermore, at three-month and six-month follow ups, 74% and 86%, respectively, of patients treated with VergenixSTR showed at least a 25% reduction in pain and improvement in motion as measured by PRTEE. In contrast, a study of the standard-of-care for tennis elbow therapies published in 2010 in the American Journal of Sports Medicine, or AJSM, reported that, at three and six months, 48% and 36%, respectively, of steroid patients showed at least a 25% reduction in pain and improvement in motion as measured by PRTEE. Also at the three-month and six-month follow ups, 62% and 64%, respectively, of patients treated with VergenixSTR showed at least a 50% reduction in pain and improvement in motion as measured by PRTEE, whereas the 2010 AJSM study showed 33% and 17% reductions at three and six months, respectively, for this same measurement.

In October 2016, we received CE marking certification for VergenixSTR. Following adoption by key opinion leaders and establishment of sales in Europe, we intend to pursue FDA approval for VergenixSTR in the United States under the PMA regulatory pathway. In November 2016, we entered into an exclusive distribution agreement with Arthrex GmbH in Munich, Germany, an affiliate of Arthrex, Inc., for VergenixSTR covering Europe, the Middle East, India, and certain African countries.

VergenixFG—Wound Filler

VergenixFG is an advanced wound care product candidate intended for the treatment of deep surgical incisions and wounds, including diabetic ulcers, burns, bedsores, and other chronic wounds that are difficult to heal. The VergenixFG formulation provides a scaffold of pure human collagen that fills the wound bed and is engineered to create maximal contact with the surrounding tissue, which is believed to enhance healing. In a cutaneous full-thickness wound pig model, 95% wound closure was

5

observed with VergenixFG at day 21 compared to 68% closure in wounds treated with the benchmark product. The researchers concluded that VergenixFG is effective in animal wound models, and it is expected to be capable of reducing the healing time of human wounds.

We have completed an open label, single arm, multi-center clinical trial of VergenixFG of 20 patients in Israel intended to demonstrate safety and to evaluate the performance of VergenixFG in patients with hard-to-heal chronic wounds of the lower limbs. Patients enrolled in the trial received a single treatment of VergenixFG followed by a four-week follow up. Product performance was examined according to several measures, the main one being the percentage of wound closure achieved.

In November 2015, we announced final results of the trial, which indicated that VergenixFG is safe for use on human subjects. An analysis of the final results found average wound closure rates of 80% within four weeks of treatment, with 9 of the 20 patients treated (45%) achieving full wound closure in that time period. In contrast, according to a scientific study published in 2014 in the International Wound Journal treatment with the current standard-of-care resulted in complete wound closure after 12 weeks of treatment in just 24% of patients for wounds comparable in their severity to the wounds treated in our VergenixFG trial.

In February 2016, we received CE marking certification for VergenixFG. In June 2016, we entered into our first distribution agreement with an Italian company to distribute VergenixFG in Italy, and in July 2016, we supplied our first order. Subsequently, in August 2016, we entered into our second distribution agreement with a Swiss company to distribute VergenixFG in Switzerland. We intend to enter into additional distribution agreements in Europe, and following adoption by key opinion leaders and establishment of sales in Europe, we intend to pursue regulatory approval for VergenixFG in the United States under the PMA regulatory pathway.

CollPlant Surgical Matrix

The CollPlant Surgical Matrix is a novel resorbable carrier composed of rhCollagen and synthetic minerals which is intended to be charged with a BMP developed by Bioventus for use as a bone graft substitute in bone repair indications such as spinal fusion and trauma. The CollPlant Surgical Matrix is being developed in collaboration with Bioventus, a global leader in active orthopedic healing. We are party to a non-binding term sheet entered into on July 9, 2015 with Bioventus for the license and supply of the CollPlant Surgical Matrix. While negotiations for a binding license and supply agreement are ongoing, no license and supply agreement has been entered into and there can be no assurance that we will enter into any definitive agreement with Bioventus.

The CollPlant Surgical Matrix charged with a BMP, which we refer to as the Bioventus product candidate, is intended to induce cell infiltration and proliferation, healing existing bone and producing new natural bone, with a dose far below that of the current market-leading bone graft, which is expected to address safety concerns associated with that product, while offering at least equivalent efficacy. The Bioventus product candidate was tested in different animal models to verify its performance in bone healing. In these preclinical studies, the Bioventus product candidate demonstrated at least equivalent efficacy to the current market leading product, while requiring only one-tenth of the BMP dosage. In anticipation of filing an IND, Bioventus is undertaking preclinical animal studies comparing the CollPlant Surgical Matrix to other active comparators. These preclinical studies are based on animal models, including non-human primate studies, which may not be indicative of results in clinical trials with human subjects.

Future Product Candidates

We have several additional projects which are in different stages of development. We currently have in-house research and development projects related to the use of VergenixSTR for tendon

6

rupture. We estimate that there are approximately 400,000 tendon tears in the United States annually. In addition, we are in pre-clinical development of VergenixFG for surgical and trauma wounds. We estimate that there are over 3.6 million surgical procedures worldwide per annum. We are actively seeking collaborators for both these indications. We are also developing BioInks consisting of our rhCollagen suitable for 3-D printing of tissues and organs. According to Grand View Research, the 3D bioprinting market is expected to reach $1.8 billion by 2022. Our researchers have chemically modified the gelling behavior of the collagen to adapt the biological molecules for application in printing. In addition, we are researching the production of other extracellular proteins through our plant-based production system.

Our Market Opportunity

We are initially focused on the orthobiologics and advanced wound care markets. In 2014, GlobalData estimated that the major segments of the orthobiologics market, including bone allograft, bone graft substitutes, and viscosupplementation, comprised an annual $6.7 billion worldwide market. The overall increase in prevalence of musculoskeletal disorders combined with technological advancements in the orthobiologics field are fueling the growth of this market, resulting in a compound annual growth rate, or CAGR, of 7.7% in the North American market from 2014 to 2019, as predicted by MicroMarket Monitor. The advanced wound care market, which includes device-based wound care, moist wound care products, and biologics, was estimated by Espicom to be $6.2 billion in 2013, representing a growth rate of approximately 5% since 2012.

We believe the market opportunity for our current product candidates utilizing our rhCollagen platform technology exceeds $5 billion. VergenixSTR is an orthobiologic addressing indications within the soft tissue repair market. There are over 4.4 million procedures for the treatment of tendinopathy per year in the United States alone. We estimate the size of the target market for VergenixSTR for treating tendinopathy is three million procedures per year, or approximately $2.0 billion.

The Bioventus product candidate, which incorporates the CollPlant Surgical Matrix, is an orthobiologic which addresses indications within the bone repair market. It is intended to be used as a bone void filler. We estimate that the size of the target market for the Bioventus product candidate incorporating the CollPlant Surgical Matrix was approximately 450,000 spinal fusion procedures per year in the United States, representing a market size of approximately $1.8 billion. We believe this product candidate will have wide applicability in skeletal procedures, and we expect that it will be used in multiple markets, including spinal fusion.

VergenixFG addresses indications within the advanced wound care market, and is intended for the treatment of deep surgical wounds and chronic wounds. The National Center for Health Statistics reported a total of 51.4 million inpatient surgical procedures took place in the United States in 2010, and we believe at least half of those resulted in a major surgical wound that could benefit from an advanced wound closure product such as VergenixFG to facilitate healing. In 2013, Medscape reported that chronic wounds affect 5.7 million patients annually in the United States alone. We estimate that the addressable market for the VergenixFG product candidate within the global advanced wound care market is approximately $3 billion.

Risk Factors

Our business is subject to numerous risks, as more fully described in the section titled "Risk Factors" immediately following this prospectus summary. You should read and carefully consider these risks and all of the other information in this prospectus, including the financial statements and the

7

related notes included elsewhere in this prospectus, before deciding whether to invest in the ADSs. In particular, such risks include, but are not limited to, the following:

Implications of Our Emerging Growth Company and Foreign Private Issuer Status

As a company with less than $1.0 billion in revenue for our year ending December 31, 2015, we qualify as an "emerging growth company" under Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of certain exemptions from reporting requirements that generally apply to public companies, including the auditor attestation requirements with respect to internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, compliance with new standards adopted by the

8

Public Company Accounting Oversight Board requiring mandatory audit firm rotation or auditor discussion and analysis, exemption from say-on-pay, say-on-frequency, and say-on-golden parachute voting requirements, and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. We have elected not to avail ourselves of an exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards. This election is irrevocable.

We will remain an emerging growth company until the earliest of: (i) the last day of our fiscal year during which we have total annual gross revenue of at least $1.0 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a "large accelerated filer" under the Securities Exchange Act of 1934, as amended. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act.

Upon completion of this offering, we will also be subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are applicable to "foreign private issuers," and under those requirements we will file reports with the Securities and Exchange Commission, or SEC. As a foreign private issuer we are exempt from certain rules and regulations under the Exchange Act, that are applicable to other public companies that are not foreign private issuers. For example, although we intend to report our financial results on a quarterly basis, we will not be required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We will also have four months after the end of each fiscal year to file our annual report with the SEC and will not be required to file current reports as frequently or promptly as U.S. domestic reporting companies. We may also present financial statements pursuant to International Financial Reporting Standards, or IFRS, instead of pursuant to U.S. generally accepted accounting principles, or U.S. GAAP. Our senior management, directors, and principal shareholders will be exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we will also not be subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act.

With respect to home country corporate governance practices under the listing rules of the NASDAQ Capital Market, or NASDAQ Listing Rules, we intend to follow home country practice in Israel with regard to, among other things, director nomination procedures and approval of compensation for officers. In addition, we may follow our home country law instead of the NASDAQ Listing Rules that require shareholder approval for certain dilutive events, such as the establishment or amendment of certain equity based compensation plans, an issuance that will result in a change of control of the company, certain transactions other than a public offering involving issuances of a 20% or greater interest in the company, and certain acquisitions of the stock or assets of another company, amending our compensation policy from time to time, and the approval of certain interested-parties transactions.

We may choose to take advantage of any, some, or all of the exemptions available to us as an emerging growth company or as a foreign private issuer. We have taken advantage of reduced reporting requirements in this prospectus.

Accordingly, the information contained in this prospectus may be different from the information you receive from other public companies in which you hold stock. Please see the section of this prospectus titled "Risk Factors—Risks Related to the Offering and Ownership of the ADSs" for a description of exemptions that apply to emerging growth companies and foreign private issuers.

9

Reverse Split

On November 20, 2016, we effected a 1-for-3 reverse stock split of our ordinary shares and on November 21, 2016, we effected an adjustment to the ratio of ADSs to ordinary shares from one ADS representing 100 ordinary shares to one ADS representing 50 ordinary shares.

Corporate Information

We were incorporated under the laws of the State of Israel in 1981. CollPlant Ltd., our wholly owned subsidiary, was incorporated under the laws of the State of Israel in 2004 and merged with us (by way of transfer of shares) in 2010. Our principal executive office is located at 3 Sapir Street, Weizmann Science Park, Ness-Ziona 74140, Israel, and our telephone number is +972 (0) 73 2325600. Our website address is www.collplant.com. We do not incorporate the information on or accessible through our website into this prospectus, and you should not consider any information on or accessible through our website a part of this prospectus.

10

ADSs offered by us |

3,500,000 ADS | |

Ordinary shares to be outstanding immediately after this offering |

282,128,864 ordinary shares (or 308,378,864 ordinary shares if the underwriters exercise in full their option to purchase 525,000 additional ADSs). |

|

Over-allotment option |

We have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to 525,000 additional ADSs from us to cover over-allotments, if any. |

|

The ADSs |

Each ADS represents 50 ordinary shares, par value NIS 0.03 per share. You will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary, and all holders and beneficial owners of ADSs issued thereunder. To better understand the terms of the ADSs, you should carefully read the section in this prospectus titled "Description of American Depositary Shares." We also encourage you to read the deposit agreement, which is filed as an exhibit to the registration statement that includes this prospectus. |

|

Depositary |

The Bank of New York Mellon |

|

Use of proceeds |

We intend to use the proceeds from this offering to continue the development of our product candidates, to conduct research and development activities, to scale up our manufacturing capabilities, to establish our sales and marketing capabilities, and for working capital and general corporate purposes. See the section of this prospectus titled "Use of Proceeds." |

|

Risk factors |

You should read the "Risk Factors" section starting on page 15 of this prospectus for a discussion of factors to consider carefully before deciding to invest in the ADSs. |

|

Proposed NASDAQ Capital Market symbol |

CLGN |

|

Tel Aviv Stock Exchange symbol |

CLPT |

|

OTCQX symbol |

CQPTY |

Certain of our existing shareholders and an officer have indicated an interest in purchasing an aggregate of up to approximately $5,000,000 of ADSs in this offering at the public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters may determine to sell more, fewer, or no ADSs in this offering to any of these parties, or any of these parties may determine to purchase more, fewer, or no ADSs in this offering. The underwriters will receive the same underwriting discount on any ADSs purchased by these parties as they will on shares sold to the public in this offering.

Assuming that the ADSs are listed for trading on the NASDAQ Capital Market, the quoting of the ADSs on OTCQX will be discontinued prior to the completion of this offering.

11

Unless otherwise stated, the number of ordinary shares to be outstanding after this offering is based on 107,128,864 ordinary shares outstanding as of November 24, 2016, excluding, as of such date:

Unless otherwise indicated, all information in this prospectus:

12

The following summary financial information should be read together with our audited financial statements and accompanying notes, as well as the information under the section of this prospectus titled "Management's Discussion and Analysis of Financial Condition and Results of Operations." Our historical results are not necessarily indicative of results that may be expected in the future.

We have derived the following summary statements of operations data for the years ended December 31, 2014 and December 31, 2015, from our audited financial statements, and the selected financial data for the three- and nine-month periods ended September 30, 2015 and 2016, from unaudited financial statements, which have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, included elsewhere in this prospectus. Results from interim periods are not necessarily indicative of results that may be expected for the entire year.

Our historical results are not necessarily indicative of the results that may be expected in the future.

We prepare our financial statements in NIS. This prospectus contains conversions of NIS amounts into U.S. dollars at specific rates solely for the convenience of the reader. Unless otherwise noted, for the purposes of the presentation of financial data as of December 31, 2015, and for the year then ended, and of the financial data as of September 30, 2016, and for the three- and nine-month periods ended on that date, all conversions from NIS to U.S. dollars and from U.S. dollars to NIS were made at a rate of 3.758 NIS to 1.00 U.S. dollar, the daily representative rate in effect as of September 30, 2016 as reported by the Bank of Israel. The dollar amounts presented in this prospectus should not be construed as representing amounts that are receivable or payable in dollars or convertible into dollars, unless otherwise indicated.

| |

Year ended December 31, | Nine months ended September 30, | Three months ended September 30, | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2014 | 2015 | 2015 | 2015 | 2016 | 2016 | 2015 | 2016 | 2016 | |||||||||||||||||||

| |

(NIS in thousands except per share data) |

(Convenience translation into USD in thousands except per share data(1)) |

(NIS in thousands except per share data) |

(Convenience translation into USD in thousands except per share data(1)) |

(NIS in thousands except per share data) |

(Convenience translation into USD in thousands except per share data(1)) |

||||||||||||||||||||||

Statement of comprehensive loss data: |

||||||||||||||||||||||||||||

Revenues |

— | — | — | — | 92 | 24 | — | 92 | 24 | |||||||||||||||||||

Research and development expenses |

14,879 | 22,919 | 6,099 | 15,440 | 23,201 | 6,174 | 6,358 | 7,309 | 1,945 | |||||||||||||||||||

Participation in research and development expenses |

(5,145 | ) | (11,055 | ) | (2,942 | ) | (7,570 | ) | (8,519 | ) | (2,267 | ) | (3,207 | ) | (2,275 | ) | (605 | ) | ||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Research and development expenses, net |

9,734 | 11,864 | 3,157 | 7,870 | 14,682 | 3,907 | 3,151 | 5,034 | 1,340 | |||||||||||||||||||

General, administrative and marketing expenses |

3,906 | 6,950 | 1,849 | 4,195 | 6,007 | 1,598 | 1,650 | 1,805 | 480 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating loss |

13,640 | 18,814 | 5,006 | 12,065 | 20,597 | 5,481 | 4,801 | 6,747 | 1,796 | |||||||||||||||||||

Financial income |

(642 |

) |

(215 |

) |

(57 |

) |

(465 |

) |

(43 |

) |

(12 |

) |

(317 |

) |

(4 |

) |

(1 |

) |

||||||||||

Financial expenses |

25 | 51 | 14 | 224 | 292 | 78 | 14 | 88 | 23 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial expenses (income), net |

(617 | ) | (164 | ) | (43 | ) | (241 | ) | 249 | 66 | (303 | ) | 84 | 22 | ||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loss |

13,023 | 18,650 | 4,963 | 11,824 | 20,846 | 5,547 | 4,498 | 6,831 | 1,818 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loss per ordinary share, basic and diluted(2) |

0.16 |

0.22 |

0.06 |

0.14 |

0.21 |

0.06 |

0.05 |

0.06 |

0.02 |

|||||||||||||||||||

Weighted average ordinary shares outstanding, basic and diluted(2) |

80,426,986 |

84,672,767 |

83,247,360 |

98,779,989 |

88,811,799 |

106,621,797 |

||||||||||||||||||||||

13

| |

December 31, | September 30, | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2014 | 2015 | 2015 | 2016 | 2016 | 2016 As adjusted(2) |

|||||||||||||

| |

(NIS in thousands) |

(Convenience translation into USD in thousands(1)) |

(NIS in thousands) |

(Convenience translation into USD in thousands(1)) |

(Convenience translation into USD in thousands) |

||||||||||||||

Statement of financial position data: |

|||||||||||||||||||

Cash and cash equivalents |

11,062 | 5,317 | 1,415 | 7,969 | 2,121 | 20,025 | |||||||||||||

Total assets |

16,958 | 13,529 | 3,600 | 18,554 | 4,938 | 22,842 | |||||||||||||

Total liabilities |

2,647 | 3,750 | 998 | 7,025 | 1,870 | 1,870 | |||||||||||||

Total equity |

14,311 | 9,779 | 2,602 | 11,529 | 3,068 | 20,972 | |||||||||||||

14

Investing in the ADSs involves a high degree of risk. You should carefully consider the risks we describe below, along with all of the other information set forth in this prospectus, including the section entitled "Cautionary Note Regarding Forward-Looking Statements" and our financial statements and the related notes beginning on page F-1, before deciding to purchase our securities. The risks and uncertainties described below are those significant risk factors, currently known and specific to us, that we believe are relevant to an investment in our securities. If any of these risks materialize, our business, results of operations or financial condition could suffer, the price of the ADSs could decline substantially and you could lose part or all of your investment. Additional risks and uncertainties not currently known to us or that we now deem immaterial may also harm us and adversely affect your investment in the ADSs.

Risks Related to Our Financial Condition and Capital Requirements

We have incurred significant losses since our inception and anticipate that we will continue to incur significant losses for the foreseeable future.

We are a clinical-stage regenerative medicine company, and we have not yet reported any revenue from product sales. We have incurred losses in each year since our inception in 2004, including a net loss of $5.0 million and $5.5 million for the year ended December 31, 2015 and for the nine-month period ended September 30, 2016, respectively. As of September 30, 2016, we had an accumulated deficit of $40.3 million.

We have devoted most of our financial resources to research and development, including our clinical and preclinical development activities. To date, we have financed our operations primarily through the sale of equity securities, grants from government authorities and proceeds from strategic collaborators. The amount of our future net losses will depend, in part, on the rate of our future expenditures. If and when we obtain regulatory approval to market any of our product candidates, our future revenues will depend upon the size of any markets in which our product candidates have received approval, and our ability to achieve sufficient market acceptance, reimbursement from third-party payors and adequate market share for our product candidates in those markets.

We expect to continue to incur significant expenses and operating losses for the foreseeable future. We anticipate that our expenses will increase substantially if and as we:

The net losses we incur may fluctuate significantly from quarter to quarter and year to year, such that a period-to-period comparison of our results of operations may not be a good indication of our

15

future performance. In any particular quarter or quarters, our operating results could be below the expectations of securities analysts or investors, which could cause our share price to decline.

Even if this offering is successful, we will need to raise additional funding, which may not be available on acceptable terms, or at all. Failure to obtain additional capital when needed may force us to delay, limit, or terminate our product development efforts or other operations.

We are conducting clinical and preclinical development of our product candidates and we intend to continue advancing their development. Developing medical products is expensive, and we expect our research and development expenses to continue to be a material part of our expenses, and may increase substantially in connection with our ongoing activities, particularly as we advance our product candidates in clinical trials.

As of September 30, 2016, our cash and cash equivalents were $2.1 million. We estimate that the net proceeds from this offering will be approximately $17.9 million, assuming an initial public offering price of $5.80 per ADS after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We estimate that these net proceeds, together with our existing cash and cash equivalents, will be sufficient to fund our operations for at least the next three years. However, our operating plan may change as a result of many factors currently unknown to us, and we may need to seek additional funds sooner than planned, through public or private equity or debt financings, government or other third-party funding, marketing and distribution arrangements, and other collaborations, strategic alliances, and licensing arrangements, or a combination of these approaches. While we believe that the proceeds from this offering will be sufficient to enable us to obtain CE marking certification, additional capital will be required for us to seek and obtain FDA approval. We will require additional capital to commercialize any product that receives regulatory approval. Even if we believe we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

Any additional fundraising efforts may divert our management from their day-to-day activities, which may compromise our ability to develop and commercialize our product candidates. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our shareholders, and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our ordinary shares or ADSs to decline. The sale of additional equity or convertible securities would dilute all of our shareholders. The incurrence of indebtedness would result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell, or license intellectual property rights, and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and we may be required to relinquish rights to some of our technologies or products or otherwise agree to terms unfavorable to us.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay, or discontinue one or more of our research or development programs or the commercialization of any product candidates, and we may be unable to expand our operations or otherwise capitalize on our business opportunities, as desired.

The report of our independent registered public accounting firm on our 2015 audited consolidated financial statements contains an explanatory paragraph regarding our ability to continue as a going concern.

Our recurring losses from operations and negative cash flows from operations raise substantial doubt about our ability to continue as a going concern without additional debt or equity financing. As a result, our independent registered public accounting firm included an explanatory paragraph in its

16

report on our audited consolidated financial statements for 2015 with respect to this uncertainty. Substantial doubt about our ability to continue as a going concern may materially and adversely affect the price per share of our ordinary shares or ADSs and make it more difficult for us to obtain financing. If we are unable to obtain sufficient capital in this offering, our business, financial condition, and results of operations will be materially and adversely affected, and we will need to obtain alternative financing or significantly modify our operational plans to continue as a going concern. Further, if we successfully complete and receive the net proceeds from this offering, given our planned expenditures for the next several years, including without limitation, expenditures in connection with our planned clinical trials of our product candidates, our independent registered public accounting firm may conclude, in connection with the preparation of our financial statements for 2016 or any subsequent period that there continues to be substantial doubt regarding our ability to continue as a going concern.

We have prepared our financial statements on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts of liabilities that might be necessary should we be unable to continue in existence.

We have received and may continue to receive Israeli governmental grants to assist in the funding of our research and development activities. If we lose our funding from these research and development grants, we may encounter difficulties in the funding of future research and development projects and implementing technological improvements, which would harm our operating results.

Through September 30, 2016 we had received an aggregate of $8.3 million in the form of grants from the National Authority for Technological Innovation, or NATI (formerly known as the Office of the Chief Scientist of the Ministry of Economy and Industry, or the OCS). The requirements and restrictions for such grants are found in the Encouragement of Research, Development and Technological Innovation in the Industry Law 5744-1984 (formerly known as the Law for the Encouragement of Research and Development in Industry 5744-1984), or the Innovation Law, and the regulations and guidelines thereunder. Under the Innovation Law and the regulations thereunder, royalties of 3% to 6% on the income generated from sales of products and related services developed in whole or in part under OCS programs are payable to the OCS, up to the total amount of grants received, linked to the U.S. dollar and bearing interest at an annual rate of LIBOR applicable to U.S. dollar deposits, as published on the first business day of each calendar year.

We developed our platform technologies, at least in part, with funds from these grants, and accordingly we are obligated to pay these royalties on sales of any of our current products that achieve regulatory approval. In addition, the Government of Israel may from time to time audit sales of products which it claims incorporate technology funded via OCS programs and this may lead to additional royalties being payable on additional products. As of September 30, 2016, the maximum royalty amount that would be payable by us, excluding interest, is $8.1 million. As of September 30, 2016, we paid non-material amounts in royalties to the OCS, relating mainly to the participation of strategic collaborators in product development. For the year ended December 31, 2015, we recorded grants totaling $1.2 million from the OCS. The grants represented 20% of our gross research and development expenditures for the year ended December 31, 2015. Following the full payment of such royalties and interest, there is generally no further liability for royalty payments; however, other restrictions under the Innovation Law, described below under "The OCS grants we have received for research and development expenditures restrict our ability to manufacture products and transfer know-how outside of Israel and require us to satisfy specified conditions", will continue to apply even after we have repaid the full amount of royalties on the grants.

As part of funding our current and planned product development activities, we have received a follow-up grant approval of approximately $1.5 million for fiscal year 2016.

17

These grants have funded some of our personnel, development activities with subcontractors, and other research and development costs and expenses. However, if these grants are not funded in their entirety or if new grants are not awarded in the future, due to, for example, OCS budget constraints or governmental policy decisions, our ability to fund future research and development and implement technological improvements would be impaired, which would negatively impact our ability to develop our product candidates.

The OCS grants we have received for research and development expenditures restrict our ability to manufacture products and transfer know-how outside of Israel and require us to satisfy specified conditions.

Our research and development efforts have been financed, in part, through the grants that we have received from the OCS. We, therefore, must comply with the requirements of the Innovation Law.

Under the Innovation Law, we are generally prohibited from manufacturing products developed under OCS funding outside of the State of Israel without the prior approval of the OCS. We may not receive the required approvals for any proposed transfer of manufacturing activities. In general, in addition to the requirement of obtaining approval to manufacture products developed with OCS grants outside of Israel, the royalty repayment rate would increase and we would be required to pay increased royalties, between 120% and 300% of the grants, depending on the manufacturing volume that is performed outside of Israel. This restriction may impair our ability to outsource manufacturing rights abroad. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Financial Overview—Research and Development Expenses" for additional information.

Additionally, under the Innovation Law, we are prohibited from transferring, including by way of license, the OCS-funded know-how and related intellectual property rights outside of the State of Israel, except under limited circumstances and only with the approval of the OCS committee. We may not receive the required approvals for any proposed transfer, and even if received, we may be required to pay the OCS a redemption fee, which may result in significant amounts, depending upon the value of the transferred know-how, our research and development expenses, the amount of OCS support, the time of completion of the OCS-supported research project and other factors, while the redemption fee will not exceed 600% of the grant amounts plus interest.

Approval of the transfer of know-how to an Israeli company is required, and may be granted if the recipient abides by the provisions of applicable laws, including the restrictions on the transfer of know-how and the manufacturing rights outside of Israel and the obligation to pay royalties. No assurance can be given that approval to any such transfer, if requested, will be granted.

These restrictions may impair our ability to sell our technology assets or to perform or outsource manufacturing outside of Israel, or otherwise transfer our know-how outside of Israel. It may also require us to obtain the approval of the OCS for certain actions and transactions and pay additional royalties and other amounts to the OCS. Furthermore, the consideration available to our shareholders in a transaction involving the transfer outside of Israel of know-how developed with OCS funding (such as a merger or similar transaction) may be reduced by any amounts that we are required to pay to the OCS.

If we fail to comply with the requirements of the Innovation Law, we may be required to refund certain grants previously received along with interest and penalties, and we may become subject to criminal proceedings.

The OCS is in the process of adopting regulations which deal with granting of licenses to use know-how developed as a result of research financed by the OCS. Such regulations may have an effect on us, with respect to the amount of payments to the OCS for the grant of sub-licenses to third parties. In addition, pursuant to Amendment Number 7, NATI, a statutory corporation, was established on January 1, 2016 and has replaced the OCS. Pursuant to Amendment Number 7, the current restrictions under the Innovation Law will be replaced by new set of arrangements in connection with ownership

18

obligations of know-how (including with respect to restrictions on transfer of know-how and manufacturing activities outside of Israel), as well as royalties obligations associated with approved programs, which will be promulgated by NATI. The restrictions under the Innovation Law as existed prior to the amendment continues to be in effect until the earlier of: one year following the date of appointment of all members of the NATI council or as otherwise resolved by the NATI council. We are presently unable to assess the effect, if any, of the adoption of those regulations and arrangements.

We may not be able to correctly estimate or control our future operating expenses, which could lead to cash shortfalls.

Our operating expenses may fluctuate significantly in the future for various reasons, many of which are outside of our control. These reasons may include:

It is difficult to forecast our future performance, which may cause our financial results to fluctuate unpredictably.

Because we do not yet have an established commercial operating history, and because the market for our product candidates may rapidly evolve, it is hard for us to predict our future performance. A number of factors, many of which are outside of our control, may contribute to fluctuations in our financial results assuming that we receive marketing authorizations and begin selling our product candidates. These factors may include variations in:

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, our shareholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of the ADSs.

Effective internal controls over financial reporting are necessary for us to provide reliable financial reports. Together with adequate disclosure controls and procedures, effective internal controls are

19

designed to prevent fraud. Any failure to implement required new or improved controls or difficulties encountered in their implementation could cause us to fail to meet our reporting obligations. In addition, any testing by us conducted in connection with Section 404 of the Sarbanes-Oxley Act may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses, may require prospective or retroactive changes to our financial statements, or may identify other areas for further attention or improvement. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of the ADSs.

We are required to disclose changes made in our internal controls and procedures on an annual basis and our management is required to assess the effectiveness of these controls annually. However, for as long as we are an "emerging growth company" under the JOBS Act, our independent registered public accounting firm will not be required to attest to the effectiveness of our internal controls over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act. We could be an emerging growth company for up to five years. An independent assessment of the effectiveness of our internal controls could detect problems that our management's assessment might not. Undetected material weaknesses in our internal controls could lead to financial statement restatements and require us to incur the expense of remediation.

Risks Related to the Clinical Development and Regulatory Approval of Our Product Candidates

We currently depend heavily on the future success of VergenixSTR, VergenixFG, and the CollPlant Surgical Matrix. Any failure to successfully develop, obtain regulatory approval for, and commercialize these product candidates, independently or in cooperation with a third party collaborator such as Bioventus, or the experience of significant delays in doing so, would compromise our ability to generate revenue and become profitable.

We have invested a significant portion of our efforts and financial resources in the development of VergenixSTR, VergenixFG, and the CollPlant Surgical Matrix. Our ability to generate product revenue from our product candidates depends heavily on the successful development, approval, and commercialization of our product candidates, which, in turn, depend on several factors, including the following:

20

Our product candidates are based on novel technology, which makes it difficult to predict the time and cost of product development and potential regulatory approval.

We have concentrated our product research and development efforts on our novel rhCollagen technology. The FDA has approved very few plant-expressed products, and has not yet approved a medical device which incorporates plant-produced materials. We may experience development challenges in the future related to our technology, which could cause significant delays or unanticipated costs, and we may not be able to solve such development challenges. We may also experience delays in developing a sustainable, reproducible, and scalable manufacturing process or transferring that process to commercial partners, if we decide to do so, which may prevent us from completing our clinical trials or commercializing our product candidates on a timely or profitable basis, if at all.

In addition, the clinical trial requirements of European regulatory authorities, the FDA, and other regulatory authorities and the criteria these regulators use to determine the safety and efficacy of a product vary substantially according to the type, complexity, novelty, and intended use and market of the potential product candidates. The regulatory approval process for novel products such as ours can be more expensive and take longer than for other, better known or extensively studied medical devices or other products. Our product candidates may also be designated by the FDA or other regulatory authorities as Combination Products, which are products composed of two or more regulated components, such as a drug and a medical device, and then may be regulated as drug or biologic product, resulting in a longer regulatory approval process than the regulatory approval process for a medical device. Approvals by any regulatory authorities may not be indicative of what the FDA or other regulatory agencies may require for approval, and vice versa.

Regulatory requirements governing medical devices and other products for medical use have changed frequently and may continue to change in the future. Also, before a clinical trial can begin, an institutional review board, or IRB, at each institution at which a clinical trial will be performed must review the proposed clinical trial to assess the safety of the trial. In addition, adverse developments in clinical trials of medical devices and products conducted by others may cause European regulatory authorities, the FDA, or other regulatory authorities to change the requirements for approval of any of our product candidates.

These regulatory agencies and additional or new requirements may lengthen the regulatory review process, require us to perform additional studies, increase our development costs, lead to changes in regulatory positions and interpretations, delay or prevent approval and commercialization of our product candidates, or lead to significant approval and post-approval limitations or restrictions. As we advance our product candidates, we will be required to consult with these regulatory authorities, and comply with applicable requirements. If we fail to do so, we may be required to delay or discontinue development of our product candidates. Delay or failure to obtain, or unexpected costs in obtaining, the regulatory approval necessary to bring a potential product to market could impair our ability to generate product revenue and to become profitable.

We may find it difficult to enroll patients in our clinical trials, and patients could discontinue their participation in our clinical trials, which could delay or prevent clinical trials of our product candidates.

Identifying and qualifying patients to participate in clinical trials of our product candidates is critical to our success. The timing of our clinical trials depends on our ability to recruit patients to participate in our clinical trials. We may experience delays in patient enrollment in the future. If patients are unwilling to participate in our clinical trials because of negative publicity from adverse events in the biotechnology, pharmaceutical or medical technology industries, or for other reasons, including competitive clinical trials for similar patient populations, the timeline for recruiting patients, conducting trials, and obtaining regulatory approval of potential products may be delayed. These delays could result in increased costs, delays in advancing our product development, delays in testing the effectiveness of our technology, or termination of the clinical trials altogether.

21

We may not be able to identify, recruit, and enroll a sufficient number of patients, or those with required or desired characteristics to achieve diversity in a trial, to complete our clinical trials in a timely manner. Patient enrollment is affected by factors including: